FAQs

Select Category and Subcategory to know your FAQ's Solutions.

Ans : No. It is not permissible. Any such deduction is a criminal offence.

Ans : No. It is specifically barred under section-12 of the EPF & MP Act,1952.

Ans : Yes.

Ans : The wages paid in a calendar month will be taken to determine the contribution due.

Ans : After realising the dues, the PF members will be given full interest for each due month and it will in no way affect the interest due to members on the contributions paid. The employer shall be charged penal interest under section 7Q and penal damages under section 14B of the Act respectively.

Ans : No. In the absence of wages & Employer no recovery can be affected. Any contribution by the member must be matched with employer’s share of contribution.

Ans : The Employees’ PF Organization will invoke penal provisions of the Act to recover the dues from the employer. Complaint can be lodged with Police under section-406/409 of IPC by the EPFO for action against such employers.

Ans : The Provident Fund amount due to the member will be paid only to the extent of the amount realised from the employer.

Ans : No. It is totally prohibited.

Ans : Attachment of Bank Accounts, Realisation of dues from Debtors, Attachment & Sale of properties, Arrest and Detention of the Employer, Action under Section 406/409 of Indian Penal Code and Section 110 of Criminal Procedure Code, Prosecution under section 14 of the EPF & MP Act,1952.

Ans : The Annual P.F. Statement of Account/Member Passbook will indicate the amount paid by the employer. The default period in a year is thus made known to the members. In the current scenario if the member has activated her/his UAN the non-payment/payment of contributions can be verified every month through the e-passbook. Currently, members also receive sms on their registered mobile phones on credit of monthly contribution into their PF account.

Ans : No. The Provident Fund enjoys protection against attachment by any Court also as per the provisions of section 10 of the EPF & MP Act,1952.

Ans : The employer, before paying the member his wages, is required to deduct the PF contribution from his wages and pay to the Regional PF Commissioner. As such PF can be deducted.

Ans : Yes. The member can pay voluntary contribution in excess of his normal contribution of 12% of Rs.15000/-. The total contribution i.e., voluntary + mandatory can be up to Rs.15000/- per month. (The employer may restrict his own share to the statutory rate). The member can also contribute on higher wages i.e., >15000/- after getting permission from APFC/RPFC as per the provisions of para-26(6) of the Scheme.

Ans : Yes. The contribution card of each member in Form 3-A/ECR copy can be demanded from the employer.

Ans : It is the duty of the principal employer to ensure that the Contractor discharges his liability. The Principal Employer must allow payment of bills after ensuring that the Contractor has enrolled and complied in respect of all eligible contract employees every month. The Principle Employer can check the remittance and employee name by using the Establishment Search option available in our website www.epfindia.gov.in. The path is OUR SERVICES >> For Employers >> Important Links >> Establishment Search (Also view Remittances and member name). If the Principal Employer ensures that all contract employees activate their Universal Account Number (UAN), then any default by the contractor can be nipped in the bud.

Ans : The Pension contribution is only a diversion from the employer’s share of Provident Fund. Hence no consent is required from the member and refusal does not arise.

Ans : No. The Employees’ Provident Fund Contribution should be paid till the date of his leaving the service, irrespective of the age of the member. Employees who ceases to be EPS(pension) member will get Employers 8.33% contribution in PF.

Ans : He can approach the Regional P.F. Commissioner in charge of grievances; file a complaint on the website using the EPFiGMS feature in the section ‘FOR EMPLOYEES’. The url for the grievance page is http://epfigms.gov.in/ or he can appear before the Commissioner in the ‘Nidhi Apke Nikat’ program being conducted on 10th of every month.

Ans : Only in the case of resignation from service (not superannuation) a member has to wait for a period of two months for withdrawal of the PF amount.

Ans : It is the duty of the employer to attest the application form. In case of any dispute, the member may attain attestation preferably from the bank in which he has maintained his account and thereafter submit the same to Regional PF Commissioner, explaining the reasons for not obtaining the signature of the employer. The Regional P.F. Commissioner will pursue the matter with the employer wherever necessary.

If the member has activated his Universal Account Number and linked his bank account and Aadhaar then he can submit composite claim (Aadhaar) which only requires the signature of the member.

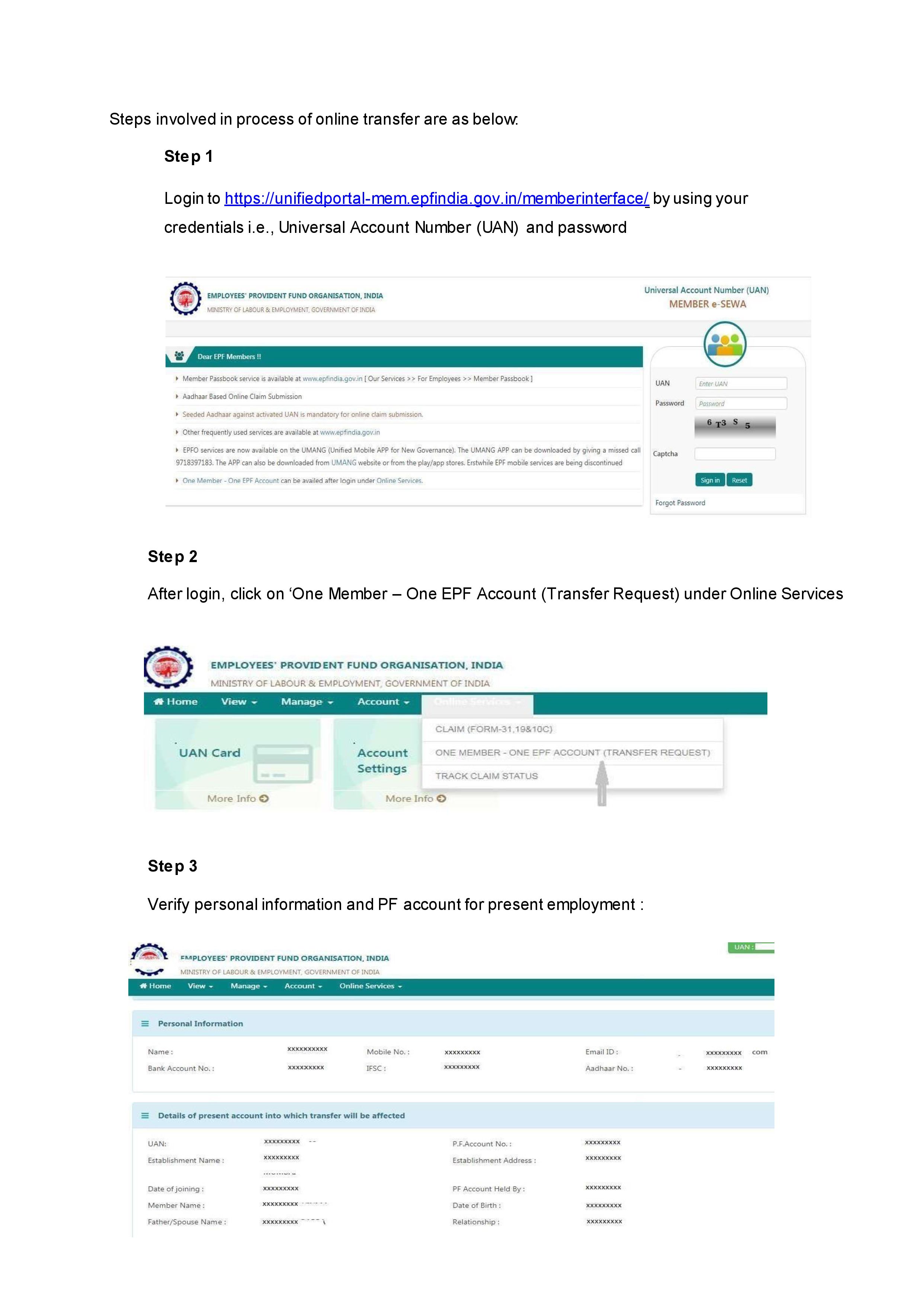

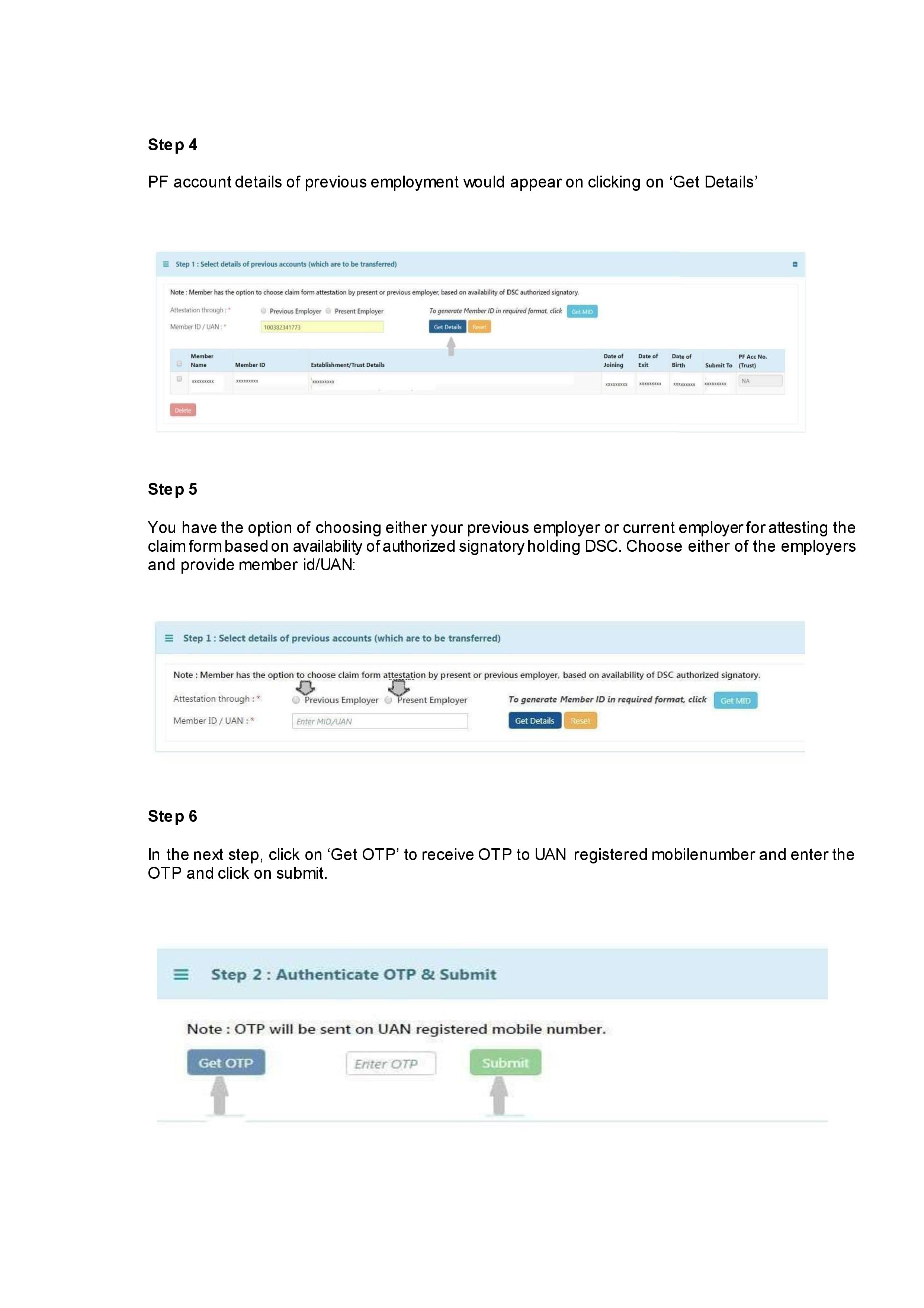

Ans : On change in employment, the member should necessarily get his PF account transferred to his present establishment, duly submitting Form 13(R). A member can submit claim for transfer online using member interface at unified portal.

Ans : The local RPFC will ensure transfer of securities/cash and arrange for refund of dues to the members.

Ans : A copy of Transfer Certificate (Annexure-K) issued to the transferee Regional P.F. Commissioner/P.F. Trust giving full details of the transfer can be requested from the EPF office.

Ans : The compound interest is credited on monthly running balance basis at the statutory rate declared for each year. For 2016-17 the interest declared is 8.65%.

Ans : No. But, non-refundable loans for housing are available.

Ans : An employee can become a member only after the application of the Act to the establishment.

Ans : He can approach his employer failing which he can approach the Regional Provident Fund Commissioner of the nearest PF office.

Ans : The Act is applicable to an establishment as a whole. Hence, its employees, irrespective of their place of work or location, are eligible to become member of the Fund.

Ans : His membership is reckoned separately for each establishment. (Under different Provident Fund Account Numbers/ member Ids)

Ans : There is no age restriction for becoming a member of the Provident Fund, whereas an employee who has already attained the age of 58 cannot become a member of the Pension Fund.

34 - Whether an employee can become a member of the EPF without any restriction to his salary/wages?

Ans : The employees who are drawing the basic wages and dearness allowance up to Rs.15, 000/- are alone eligible to become a member. He will continue to be a member even when his pay exceeds Rs.15, 000/-. However, his contribution to the Fund will be restricted to Rs.15, 000/-. The employer is also required to pay his matching contribution up to Rs.15, 000/-. Employees drawing more than Rs.15000/- can also become a member of EPF by giving option under para 26(6) of the EPF Scheme. The option has to be submitted to the EPF office within 6 months of joining of such member.

Ans : No. But, when he ceases to be an apprentice he should be enrolled immediately.

Ans : Such employee is not required to become a member, if he is not already holding the PF membership. Otherwise, if both the employer and employee are willing, he can become a member by giving option under Para-26 (6) of the PF Scheme. The option has to be submitted to the EPF office within 6 months of joining of such member.

Ans : He is required to be enrolled as a member under the new establishment, for transferring his Provident Fund from his previous account.

Ans : Membership is allowed only where the wages are payable to an employee.

Ans : No. By virtue of membership of Provident Fund only one can become a member of the Pension Scheme. From 01/09/2014 any new employee joining an establishment and drawing basic wage more than Rs.15000/- per month can only become a member of the PF after submitting option as per the provisions of Para 26(6) of the EPF Scheme. However, he can not get the membership to the Pension Fund. Both employee share of 12% and employer share of 12% contribution shall be paid into the Provident Fund only for all such employees.

Ans : Yes. If one continues to work even after attaining the superannuation age.

Ans : No option.

Ans : Not permissible.

Ans : Employee can be allowed to join the private PF Trust but the Trust has to take exemption from the EPF Scheme. He will however continue to be governed by the Pension and EDLI Schemes. All private trusts must obtain exemption from EPFO to enjoy Income Tax benefits.

Ans : There is no restriction of period for membership. Even after leaving the establishment a person can continue his membership. However, if no contribution is received into a PF account for 3 consecutive years the account shall not earn any interest after 3 years from the stopping of contribution.

Ans : Non employment period is not affecting the EPF but affects the calculation of service to decide the quantum of benefit under the Employees’ Pension Scheme.

Ans : During such period the membership will continue and in the absence of wages no recovery of contribution will be made.

Ans : No. It is only by way of employment in an establishment covered under the provisions of the EPF & MP Act, 1952.

Ans : If the employer of the Security Guard has been brought under the Act, the membership will be given through the employer, irrespective of his place of work.

Ans : Yes. The majority of employees and the employer can voluntarily opt for joining the Scheme as per provisions of Section-1(4) of the Act (Voluntary Coverage).

Ans : On joining the EPF, the member is provided the benefits under Pension (restricted to employees with Rs.15000/- or less monthly wage) and Employees’ Deposit Linked Insurance Scheme.

Ans : He is required to join only the PF and he cannot become a member of the Pension Scheme.

Ans : The membership can be retained till the withdrawal of his Provident Fund dues. However, if the account does not receives any contributions for more than 3 years interest won’t be credited to the account after the 3rd year.

Ans : It is payable to the family members in equal shares, under Para 70 (ii) of EPF Scheme, 1952. If there is no eligible family member, it is payable to the person(s) who are legally entitled to it.

Ans : On the death of a Pension member (before receiving the pension), if there is no eligible family member, pension is payable to the nominee.

Ans : Payable to the dependant parents, (dependant father followed by dependant mother).

Ans : Yes. But, on acquiring a ‘Family’ the nomination is treated as invalid and the benefits under EPS-1995 shall be paid to the spouse and children, if any.

Ans : Pension= (Pensionable Salary (average of last 60 months) X Pensionable Service)/70.

Ans : A member who joins the Employees’ Pension Scheme 1995 at the age of 23 and superannuates at the age of 58, and contributing to the (present) wage ceiling of Rs.15000/- may get about Rs.7500/- as pension if service is 35 years.

(Pensionable Salary X Pensionable Service)/70 = (15000x35)/70 = 7500

(Pensionable Salary X Pensionable Service)/70 = (15000x35)/70 = 7500

Ans : The average salary is determined only for giving the pension to member. It is the average of last 60 months. (Non-contributory period, if any, is reduced)

Ans : 1) It facilitates transfer of Pension Accounts when the employment is changed. 2) If the Holder of Scheme Certificate dies the family will get family pension.

Ans : Family pension is payable i.e. in addition to the Military Pension, i.e. family pension under Rule 54 of the CCS (Pension) Rules, 1972. (Effective from 27-07-2001 only)

Ans : Individual member cannot seek exemption from the Pension Scheme. Only an establishment can seek exemption.

Ans : A member is eligible for pension on superannuation at the age of 58 years. If a member leaves employment between 50 and 57 years he can avail the early (reduced) pension.

Ans : In case of death of a member, The family pension and children pension is payable even after receiving one month’s contribution (including part of the month) for Pension Fund.

Ans : On death of the member the Pension is automatically payable to the spouse (Widow/Widower). In addition, the children are also eligible till attainment of 25 years of age (2 at a time). Any disabled child in the family shall get disabled pension for life apart from the two child pensions.

Ans : Non-payment of pension contribution by an employer will not affect the grant of Pension. Pension is guaranteed.

Ans : The wages and the service of the member are consolidated to determine the Pension.

Ans : No. Once Pension is sanctioned it cannot be altered.

Ans : The member is required to indicate his option regarding the date from which he requires early pension in the application form. If no date is given in the claim form then the date of application shall be taken as the opted date.

Ans : The member who continues in service even after 58 years can avail the Pension from the age of 58. If a pensioner, who has availed the early pension, may take up employment thereafter and in such cases he will not be eligible to join the Pension Scheme. And the 8.33% contribution from Employer side will go towards EPF fund.

Ans : No. A member can withdraw his PF amount (member share only) and maintain a lien in the Pension Scheme by availing a Scheme Certificate.

Ans : Yes. Date of Birth/Age once given is not normally changed, however it can be changed with proper documentary evidence. You can see the guidelines provided in circular ‘Change of Date of Birth for EPF & EPS members’ dated 03/04/2020, available on our website (https://www.epfindia.gov.in/site_docs/PDFs/Circulars/Y20202021/Circular_on_date_of_Birth_0302020.pdf).

Ans : The marital status has no relevance if the children are below 25 years; they are eligible for family pension in the event of demise of the member.

Ans : If the second marriage is legally valid, it is payable to the eldest wife with reference to the date of marriage and on her death, payable to the next surviving widow.

Ans : No. In the absence of family member on the date of the death of the member (before eligibility for member pension), the family pension is payable to nominee and in the absence of a valid nomination it is payable to dependent father followed by dependent mother. Once the pension is received by the member there is no validity for nomination. A pensioner cannot nominate any person.

Ans : The unemployment period will be excluded from the actual service. Pension is based on contributory service only.

Ans : No. The spouse is an automatic beneficiary unless he/she is legally divorced.

Ans : It is payable to the dependant parents.

Ans : EPS-95 member irrespective of age and service who is permanently and totally disabled during the employment shall be entitled to Pension. A member applying for benefits under this provision shall be required to undergo such medical examination prescribed by the Central Board to determine whether or not he or she is permanently and totally unfit for the employment which he or she was doing at the time of such disablement.

Ans : The pension and family pension under Employees’ Pension Scheme, 1995 are the Social Security benefits. It is viewed as a need based benefit. It is not related to the quantum of contribution paid by a member. A pensioner after attaining the age of 58 years is to take care of his spouse and in his absence the liability is restricted to one person. Hence 50% of the pension is payable. Whereas in the case of a member (non-pensioner) who dies leaving behind his spouse, children who are yet to complete their education, marriage etc. and also considering the pre-mature death of a member the quantum of pension payable to non-pensioner’s widow is on the higher side.

Ans : The widow of a pensioner is eligible for family pension (irrespective of the date of marriage whether prior to his superannuation or thereafter)

Ans : The pension payable to the widow/widower will be stopped and thereafter the children pension will be converted to orphan pension (75% of the widow pension).

Ans : Pension is paid till the remarriage of the widow/widower or till death.

Ans : The children of both first and second wife should be arranged in the order of their date of birth and then the children pension is allowed to the eldest two children but below 25 years of age.

Ans : No. The pension should be drawn by widow and children in the same bank and branch.

Ans : A member whose service is 10 years or more and not attained the age of 58 years will be mandatorily issued scheme certificate. A member whose service is less than 10 years can avail the Scheme Certificate to carry forward his pension service but it is not mandatory for such member.

Ans : All pensioners drawing pension under Employees’ Pension Scheme, 1995 are required to give a Life/Non-Remarriage Certificate, duly attested by the Bank Manager/Gazetted Officer after 12 months from the month in which the pension was sanctioned or date of submission of last Life certificate. Physical Life Certificate is to be submitted to the Bank through which the pension is being paid. Failure to submit Life Certificate after one year will result in stoppage of pension after 12 months from the date of submission of last Life Certificate or sanction of pension in case of new Pensioners. In place of physical life certificate ‘Digital Life Certificate’ (DLC) has been introduced from the financial years 201516. Now Pensioners can use their Aadhaar number to submit the DLC. The facility to submit DLC is available in ‘Common Service Centers’ (CSCs), branches of Pension Disbursing Banks, ‘Post Offices’ through ‘India Post Payment Banks’ (IPPB) as well as PF offices.

Ans : Yes. But it is advisable that the member should complete 10 years of pensionable service so that he gets eligible for pension under the EPS 1995 on attaining the age of 50 years (early/reduced pension) or 58 years (superannuation pension).

Ans : Yes. The benefit under the Pension Scheme is a direct consequence of the contributions paid by the member of EPS, 1995; hence, if both parents were members and have contributed independently to the said Scheme, the Orphan will be eligible to two pensions separately. The normal ceiling as provided for in the Employees’ Pension Scheme shall however, continue to apply.

Ans : In respect of an establishment defaulting in remitting contribution to the Employees’ Pension Fund 1995 for any period, withdrawal benefit will not be paid to the member in respect of the default period. The member is entitled to withdrawal benefits only in respect of the period for which the contributions are received.

Ans : Yes, the member has option to delay the pension beyond 58 years:

1) Member can opt for receiving pension after attaining 59 or 60 years of age but pension contribution stops after 58 years. In this scenario quantum of pension is increase by 4% per year beyond 58 years.

2) Member can opt for receiving pension after attaining 59 or 60 years of age but pension contribution continues after 58 years. In such a scenario the quantum of pension shall be higher than the first case cited above.

Ans : No. Admissible only in case of death while in service.

Ans : EDLI benefit is payable to the persons eligible to receive the EPF dues.

Ans : Payment of Assurance Benefit under EDLI Scheme 1976 is only available on the member’s death while in service to the nominees/legal heirs.

Ans : Currently, the maximum assurance benefit is Rs.600,000/-.

Ans : Pension is payable through the designated banks notified for each region through Core Banking Solution.

Ans : Universal Account Number (UAN) is a 12 digit number allotted to each subscriber by linking it to the member’s currently active PF account number (from 31/07/2014 to 30/11/2016). From 12/2016 any new member has to be allotted a Universal Account Number linked to the establishment’s code number.

Ans : The number is allotted by EPFO on the request of the Employer and populated in the Employer’s login in the unified portal www.unifiedportal-emp.epfindia.gov.in. The UAN can also be generated by any individual using his/her aadhaar if his UAN is not already generated.

Ans : Once the member has activated his/her UAN on the unified portal he can enjoy the following benefits:

Download/Print your Updated Passbook anytime.

Download/ Print your UAN Card.

List all your Member IDs to UAN.

File online transfer claim on OTCP

Update your KYC information.

Ans : The facility is available in the unified portal at https://unifiedportal-mem.epfindia.gov.in.

Ans : Please activate your UAN and check/download your passbook.

Ans : Please use the url https://passbook.epfindia.gov.in/MemClaimStatusUAN/ for checking your claim status.

Ans : Currently the member can submit 3 types of claims without attestation of Employer namely, Form-19, 10C and 31. However, the member must ensure that his UAN is activated and at least the bank account and Aadhaar KYC’s in respect of his account are approved by the Employer using his Digital Signature Certificate.

Ans : EPFO has launched a consolidation of the settlement claim forms. Accordingly one composite claim form (Aadhaar & Non Aadhaar) has been issued to replace the existing claim forms no.19, 10C and 31 and UAN forms no.19, 10C & 31.

Another composite form replaces the existing Form no.20, 10D & 5-IF.

Ans : Please visit EPFO Website: www.epfindia.gov.in

Ans : A person who is employed for wages in any kind of work, manual or otherwise, in or in, connection with the work of a establishment covered under the Employees’ Provident Funds & Miscellaneous Provisions Act, 1952, and who gets his wages directly or indirectly from the employer, and includes any person employed by or through a contractor in or in connection with the work of the establishment.

Ans : An employee of a covered establishment, if not excluded, is compulsorily a member of the employees’ Provident Funds Scheme. The employer of the establishment himself makes the employee a member by following prescribed procedure. An excluded employee is an employee whose pay at the time of being a member exceeds Rs. 15,000/- per month

Ans : At present, an employee contributes 12% of the Basic wages + Dearness allowance + Retaining allowance in EPF. The employer also pays 12% of pay out of which 8.33% of pay is diverted to Pension Fund and the rest 3.67% is diverted to EPF.

Ans : No. The employer pays 12% out of which 8.33% is diverted to Pension Fund. An employer also pays 0.5% of Pay in EDLI Scheme.

Ans :

- Advances: A member can take non-refundable advances during service period for various purposes:-

- Treatment of illnesses of self/family: TB, leprosy, paralysis, cancer, mental derangement heart ailment ,pandemic or major surgical operation

- Marriage of self, daughter, son, brother & sister.

- Post-matriculation education of son/daughter

- Withdrawal for purchase of house, flat, dwelling house, addition/alteration of house and repayment of loan for the purpose.

- Withdrawal within one year before retirement: Upto 90% of total PF balance.

- Advance on unemployment: Upto 75% of total PF balance.

- Other purposes (for details please see table below)

- Final settlement: On retirement or two months after ceasing to be an employee.

- Pension after retirement subject to the eligibility

- Insurance in case of death while in service.

Ans :

| S.N. | Para of EPF Scheme 1952 | Purpose | Eligibility | Amount admissible |

|---|---|---|---|---|

| 1. | 62 | Financing of Member’s Life Insurance Policies | A policy in the name of the member.

Policyshouldbe legally assigned to CBT (EPF). | Employees’ share should have sufficient balance to pay the premium. |

| 2. | 68-B, 68-BC,68- BD | Purchaseof House/flat, including acquisition of land. | Five years membership of the Fund. Employees’shareis more than Rs 1,000/- | Twenty four months wages & DA or total balance in PF account(Employees’ +Employer) or total cost, whichever is less. After five years another part withdrawal equal to 12 months wages & DA or employees’ share for addition/alteration. After ten years from the original sanction, another part withdrawal equal to 12 months wages & DA or employees’ share for addition/alteration. |

| 3. | 68-BB | Repayment of housing loan. | Loan should have been taken from notified agencies. 10 years membership of Fund. employees’ share in PF account should be more than Rs 1,000/- | Thirty six months wages & DA or total balance in PF account (employees’ + employer share) or total outstanding loan & interest thereon, whichever is less |

| 4. | 68-BC | Purchase of House/flat, including acquisition of land. | Five years membership of the Fund. employees’ share is more than Rs 20,000/- | Total balance in PF account office member or cost of acquisition, whichever is less. |

| 5. | 68-BD | Purchaseof House/flat, including acquisition of land. | Three years membership of the Fund. Member of a registered Cooperative Society. Employees’ share is more than Rs 25,000/- | 90% of PF accumulation (both shares) or cost payable, whichever is less. Employees’shareis more than Rs 25,000/- |

| 1. | 68-H | Ifestablishment / factory is closed/locked down | Employee receives no compensation or has not got wages for two months or more. | Upto 100% of employees’ share. |

| 2. | 68HH | If the employee remains unemployed for more than one month | Unemployment should be more than one month | Upto75%oftotalPF balance. |

| 3. | 68-J | Illnessof self and family | Hospitalization for more than one month, major illnesses or major surgery. | Basic Wages & DA for six months or employees’ share, whichever is less. |

| 4. | 68-K | Marriage (self ,children ,brother & sister) or post matriculation education of children | Sevenyears’ membership of fund. employees’ share in PF balance is more than Rs 1,000/- Only three withdrawals allowed. | 50% of employees’ share. |

| 5. | 68-L | Natural calamity | Natural calamity declaration by State Government & proof of damage to property. | not exceeding the basic wages and dearness allowances of that member for three months or up to seventy-five per cent. of the amount standing to his credit in the Fund, whichever is less. |

| 6. | 68-M | Cut in electricity in factory/establishment | Cut in electricity supplied by State Government. | Wages for a month or Rs 300/- or employees’ share, whichever is less. |

| 7. | 68-N | Physically handicapped members for purchaseof equipment | On account of physical handicap. | Basic Wages & DA for six months or employees’ share or cost of equipment, whichever is less. |

| 8. | 68-NN | Withdrawal one year before retirement. | Age of member is 54 years and above | 90% of total PF balance |

| 9. | 68-NNN | For investment in Varishta Pension Bima Yojana. | Age of member is 55 years and above | 90% of total PF balance. |

Ans : No document is required to be submitted.

Ans :

- Member portal: EPFO provides UAN based online account of member data on EPF website secured with login password.

- Passbook: for updated balance

- Online claim filing: A member can file online EPF claims for various benefits through member portal if the EPF account is seeded with Aadhar, PAN & Bank account.

- Online filing of transfer claim from previous account to new EPF account in case of job change from one covered EPF establishment to another EPF Covered establishment.

- Modified Declaration form (Form No-11) for automatic transfer of Funds: Member can effect transfer of EPF Fund from previous account to new account without transfer claim if both account is linked with UAN and Aadhar seeded.

Ans :

- For Final settlement/Withdrawal benefits/Advances: Composite Claim form (Aadhar/non-Aadhar)

- Scheme certificate: Form 10C

- For pension: Form 10D

- For transfer of previous account balance to new account: Form 13

- For nomination of family members: Form 2

- Declaration of previous service: form 11

Ans :

- Online: If PF account is seeded with Aadhaar, PAN and Bank account is updated. Only Composite Claim Form (Aadhaar) for PF final withdrawal, Pension withdrawal benefits and PF non-refundable advances can be filed online.

- Offline: All type of claims.

Ans : A member can update his bank account through member portal which is then approved by employer.

Ans : As per EPF Scheme, a claim is required to be settled within 20 days.

Ans : A complainant can lodge his/her grievance online on – https://epfigms.gov.in. If the complainant has UAN/Establishment/PPO number then he can directly enter his respective detail and fill his/her grievance category and description of grievance along with uploading supporting documents. Thereafter his grievance is forwarded to the concerned PF office which is linked to its UAN/Establishment/PPO number, If the complainant does not have UAN/Establishment/PPO number then he/she can register his grievance in Others category where he has to fill all the details along with the PF Office to which the grievance pertains. After successfully lodging the grievance a unique registration number is generated and sent on his mobile number or on email id. The complainant can see/check the status/disposal of his grievance on the above mentioned portal through registration number. The EPFiGMS is an interactive portal as the complainant can add additional supporting document pertaining to his grievance and EPFO offices too can ask for documents as well as seek further inputs from the complainant regarding his/her grievance. The EPFiGMS portal also has the provision for seeking feedback from the complainant with respect to quality of redressal of his/her grievance in the form of star ratings.

Ans : KYC (Know Your Customer) is member’s data updation to improve the services of EPFO for members. These KYC details include PAN, Aadhaar and Bank Account details.

If you have not yet updated these details on the EPFO Member Portal, you may do it now.

Ans : Member can update KYC details online in EPFO’s UAN Portal.

Ans : Claim can be submitted through online mode without attestation of the employer. A member can view his monthly contribution statement by logging on UAN portal.

Ans : Following documents are considered for KYC –

- National Population Register

- AADHAR

- Permanent Account Number (PAN)

- Bank Account Number

- Passport

Ans : In order to update or change in KYC (Know your customer) detail on UAN EPFO portal, a member requires UAN (Universal Account Number). Member can login to EPFO UAN portal and update KYC by uploading necessary documents online. Online request for correction in name, date of birth and gender has been introduced.

Ans : UAN (Universal Account Number) is a unique 12 digit number allotted to a member. It is a permanent number and remains valid throughout the life of a member. It does not change with the change of employment. UAN helps in automatic transfer of Funds and PF withdrawals.

Ans : Your Employer can generate the UAN. In case of change in employment, the previously allotted UAN may be provided to the employer.

Ans : Member can seed his Aadhar through Member portal, after UAN is activated by employer.

Ans : Member can seed his PAN through Member portal, after UAN is activated by employer.

Ans : Member can seed his Aadhar through Member portal, approved by employer.

Ans :

- Member can submit claims through online mode

- Member can file claim directly without employer’s signature.

Ans : An account is classified as Inoperative account in which contribution has not been received for 3 years after retirement or permanent migration abroad or in case of death.

At present, all accounts will earn interest upto 58 years age of a member.

Ans : No. However, at present, all accounts will earn interest upto 58 years age of a member.

Ans : If you are still working in an establishment covered under EPF & MP Act, 1952, you should get the amount transferred into your new account either by online or offline mode. If you have retired then you may withdraw the amount.

Ans : In case a member withdraws his EPF and has rendered less than 5 years of service and accumulated amount is more than Rs. 50,000/, TDS shall be applicable on the following rates:-

| Submission of PAN | Non submission of PAN | No TDS deducted in case of |

|---|---|---|

| If 15G/15H is submitted, no TDS is deducted If 15G/15H is not submitted,TDS deducted at 10% | TDS is deducted at Maximum Marginal Rate (34.606%) | Transfer of Fund Payment of advance Service is terminated by employer beyond control of employee |

Ans : No.The service rendered at previous as well as present employer would be added to arrive at total service.

Ans : If a member provides/link PAN and the PF balance is more than Rs. 50,000/ and service rendered is less than 5 years, then tax (TDS) would be deducted @10% and not at 34.606%.

Ans : Form 15G and Form 15H are declarations which can be submitted to receive payments without deduction of tax in case of members having total annual income of Rs. 2.50 lacs and 3.00 lacs respectively. Form 15H is applicable for Senior Citizens (60

years or older) whereas Form-15G is for everybody else. Also, a member must have a PAN before applying in these forms.

Ans : Two copies of form 15G/15H, whichever is applicable, are to be submitted with the claim forms.

Ans : Form No-2 is prescribed under Employees Provident Fund, employees’ Pension Scheme and Employee’s Deposit Link Insurance Scheme for submitting family and nomination details.

Ans : In case of a members’s death, the family can get the benefit PF/Pension/Insurance without any delay.

Ans : Member can submit Form No.-2 online through the employer. E-sign facility has also been extended to the members to submit Form No.-2 online. In case, new family member is added, the EPF member should fill Form No- 2 to update the details in EPFO. Form No.-2 can be submitted online as well as offline mode.

Ans : In such a scenario, the claim form may be attested by the Manager of the Bank in which your savings Bank Account is currently maintained. Or where the employee finds it difficult to get the attestation of the employer, the member can update the KYC by submitting a request to concerned field office duly attested by one of the authorised officials, The complete list of authorised officials is as prescribed in para 10.18 of the MAP Vol. II.

Ans : Yes. A cancelled original cheque bearing name of the member, his bank account number and IFS Code of the bank should be printed on the cheque itself.In case, members’s bank account is ‘without cheque-book’ facility, then copy of first page of passbook duly attested by the employer or the bank manager may be enclosed with the claim form.

Ans : Composite Claim Form (Non-Aadhaar) is a single page form for settlement of PF final withdrawal, pension withdrawal benefits and PF non-refundable advances. The claim is required to be submitted offline and attested by the employer.

Ans : Composite Claim Form (Aadhaar) is a single page form for settlement of PF final withdrawal, pension withdrawal benefits and PF non-refundable advances. It can be submitted both in online as well as offline mode and does not require the attestation of the employer. This form is applicable in cases where employees’ complete details in

Form No-11 (New), Aadhaar number and Bank Account details are available on UAN Portal and UAN has been activated.

Ans : All payments are made electronically through NEFT or CBS (Core-Banking Solutions).

Ans : Commutation of Pension means payment of lump sum amount in lieu of a portion of pension surrendered voluntarily by the pensioner. This option has been deleted with effect from 26.09.2008.

Ans : In the Employees’ Pension Scheme 1995, after paragraph 12, the following paragraph has been inserted which is thereby called Employees’ Pension (Amendment) Scheme 2020:

“12B. Restoration to normal pension in cases of grant of commutation - The normal pension in respect of those members who availed the benefits of commutation of pension under the erstwhile paragraph 12 A of this Scheme on or before the 25th day of September 2008 shall be restored after completion of fifteen years of the date of such commutation.”

Ans : Those members who availed the benefits of commutation of pension under the erstwhile paragraph 12 A of this Scheme on or before the 25th day of September 2008 shall be restored after completion of fifteen years of the date of such commutation.

Ans : The relevant provision in Para 12A entitled the pensioners to commute 1/3rd pension & thereafter his entitlement was to get balance 2/3rd pension. The scheme did not have any provision for restoration of the original pension of the pensioner once the pension has been commuted. However, government notification G.S.R No. 132(E) dated 20.02.2020 introduced Para 12B allowed restoration of original pension after 15 years.

Ans : The Pensioners would receive their full pension after completion of fifteen years

from the date of commutation.

Ans : Yes. EPFO is conducting webinars through its Regional Offices and Pensioners may request the concerned Office for participation to resolve any query.

Ans : EPFO has launched a scheme called ‘Prayaas- an endeavour to release Pension on the day of Superannuation’ for members of Employees Pension Scheme 1995. Members superannuating within 03 months are guided to submit Pension claims one month before the day of retirement so that Pension Claims of these employees can be settled for issuance of PPOs on the Date of retirement.

Ans : The name change process if the Aadhar data is changed is similar to other change requests. Member has to apply online and employer will digitally approve the request. The correction request can be submitted online or offline (joint request) along with a copy of the marriage certificate or such other documents which can prove that only the name of the member has changed from before marriage. Documents like school records containing Father's name and Date of birth or PAN taken before marriage etc. are a useful to show that only name has changed after marriage.

Ans : In respect of closed establishment, where the employee finds it difficult to get the attestation of the employer, the member can update the KYC by submitting a request to concerned field office duly attested by one of the authorised officials, The complete list of authorised officials is as prescribed in para 10.18 of the MAP Vol. II.

Ans : As per prevailing instructions it is mandatory to upload a cheque leaf containing the printed name of the member, or the first page of the bank Passbook or bank statement containing the name, account number and IFSC. This is required to ensure that the bank account number uploaded in the KYC is correct and erroneous payments are avoided.

Ans : Services will be resumed shortly. Pending resumption of services, you may contact us on our Facebook and twitter handle “socialepfo”, Quora page of EPFO. You can raise your grievances at https://epfigms.gov.in

Ans : The advance to fight COVID-19 pandemic is available once only.

Ans :

- Visit unified member portal at https://unifiedportal-mem.epfindia.gov.in/memberinterface

- -> Select Member ID, Aadhaar or PAN

- -> Enter details such as name, date of birth, mobile number and e-mail id as per EPFO records.

- -> Click on the “Get Authorization Pin” option

- -> A Pin will be sent to your mobile number registered with EPFO .

- -> Enter the Pin and your UAN will be sent to the mobile number.

Ans :

- You should approach EPF office where your establishment is registered. To find concerned EPF office where your establishment is registered visit https://unifiedportal-epfo.epfindia.gov.in/publicPortal/no-auth/misReport/home/loadEstSearchHome

- -> Fill in establishment PF code or name

- -> Enter captcha and click on search .

- -> Establishment details will appear in tabular format.

- -> A Pin will be sent to your mobile number registered with EPFO Confirm the establishment Id, Name and Address and in column four EPF office name is provided.

Ans : That a new sub-para (3) has been inserted in Paragraph 68L of the EPF Scheme, 1952 through GSR No.225(E) published in the Gazette of India (Extraordinary), Part II- Section 3- sub section (1) on 28.03.2020 to provide for benefit.

Ans : It is to provide for non-refundable advance from their EPF account to EPF members, employed in factory or establishment located in an area, which is declared to be affected by outbreak of epidemic or pandemic by the Appropriate Govt.

Ans : No certificate or documents are to be submitted by member or his/her employer for availing the benefit.

Ans : If the balance in member’s EPF account as on date is Rs.50,000/- and monthly basic wage and dearness allowance is Rs.15,000/- 75% of balance of Rs.50000/- is Rs.37,500/- & amount of three months wage is Rs.45000/-. So member is eligible to get Rs.37,500/- the least of two amounts.

Ans : Like claim for all other types of advances, the claim for this advance also can be filed Online if your UAN is validated with Aadhaar and KYC of Bank account and Mobile number is seeded in UAN

Ans :

- On the home page of website- https://www.epfindia.gov.in/site_en/index.php under the TAB “COVID-19” on top right hand corner, instructions for filing online advance claim is hosted.

- The process is also noted below:

- -> Login to Member Interface of Unified Portalhttps://unifiedportal-mem.epfindia.gov.in/memberinterface

- -> Go to Online Services>>Claim (Form-31,19,10C & 10D)

- -> Enter your Bank Account and verify

- -> Click on “Proceed for Online Claim”

- -> Select PF Advance (Form 31) from the drop down

- -> Select purpose as “Outbreak of pandemic (COVID-19)” from the drop down

- -> Enter amount required and Upload scanned copy of cheque and enter your address

- -> Click on “Get Aadhaar OTP” i

- -> Enter the OTP received on Aadhaar linked mobile.

- -> Claim is submitted

Ans :

- Yes, from your mobile phone you can either

- i) login to (https://unifiedportal-mem.epfindia.gov.in/memberinterface ) and follow steps a. to j as in Ans to Q9 to file claim OR

- ii) Through UMANG (Unified Mobile Application for New-age Governance) Mobile APP Home> EPFO> Employee Centric Services> Raise Claim> Login with your UAN and OTP received on your mobile number registered with UAN to file claim

Ans : The claim for this advance can be filed Online if your UAN is validated with Aadhaar and KYC of Bank account and Mobile number is seeded in UAN. You are requested to complete your KYC by submitting same on Member Portal. If your basic details that are name, date of birth and gender against UAN are same as that in Aadhar, you can link your Aadhar through eKYC Portal. In case of mis-match in KYC details and details in EPF account, please submit online request for demographic detail correction through your employer. The bank account details have to be digitally approved by the employer. For submitting your claim online your aadhar linked mobile will get OTP. So your aadhar should be linked with a mobile

Ans : Withdrawal to the extent of the basic wages and dearness allowances for three months or up to 75% of the amount standing to your credit in the EPF account, whichever is less, is maximum permissible limit. You can apply for lesser amount also.

Ans : If the member has more than one PF member IDs (MIDs) and the PF amount of these MIDs has not been transferred into the latest MID, member is required to get his PF transferred into his current MID.

Ans : Universal Account Number (UAN) acts as an umbrella for the multiple Member IDs allotted to an individual by different employers. UAN enables linking of multiple EPF Accounts (Member Id) allotted to a single member. UAN offers a bouquet of services like dynamically updated UAN card, updated PF passbook including all transfer-in details, facility to link previous members’ PF ID with present PF ID, monthly SMS regarding credit of contribution in PF account and facility for autotriggering transfer request on change of employment.

Ans :

- For online PF transfer please ensure following-

- i. Employee should have activated his UAN at https://unifiedportal-mem.epfindia.gov.in/memberinterface/portalMobile number used for activation should also be active as OTP will be sent in this number.

- ii. Aadhar number, Bank account of employee should have been seeded against the UAN.

- iii. The date of exit for the previous employment must have been entered. If date of exit is missing kindly follow the process as given in this FAQ for updation of date of exit.

- iv. The employer should have approved the e-KYC.

- v. Only one transfer request against the previous member ID can be accepted.

- vi. Personal details reflecting under the “Member Profile” must be verified and confirmed before applying

Ans : Yes, updation of date of exit of previous job/employment is mandatory for applying online transfer. The date of exit can be updated only after two months of leaving a job. Also, the date of exit can be any date in the month in which the last contribution was made by the previous employer.

- This facility is based on Aadhaar-based one-time password (OTP). Thus it can only be utilized by those who have activated their UAN and linked their UAN with a verified Aadhaar number and have mobile linked to Aadhar number for receiving the OTP sent for verification

Ans :

- i. Go to the https://unifiedportal-mem.epfindia.gov.in/memberinterface/ and login using your UAN and password

- ii. Click on tab “manage" >> click “mark exit". Under the “select employment” dropdown, select the previous PF account number linked to your UAN

- iii. Enter the date and reason of exit.

- iv. Then request for an OTP which will be sent to your Aadhaar-linked mobile number.

- v. After you enter the OTP, submit the request. It may be noted that once the date of exit is updated, it cannot be changed.

Ans : The member can check this by viewing his passbook. The member must log in to his member unified portal. In the homepage itself the member must go to View > Passbook. Thereafter the member must enter his UAN, password and captcha to login once again. After login the member can view the passbook of all his MIDs. If his PF has been transferred then the same will be shown as a credit entry in this latest passbook. Otherwise all the passbooks of his previous MIDs will show some balance. In such a case the member is advised to submit online transfer claim.

Ans : A member whose UAN is seeded and is fully KYC complaint must not file any transfer claim on change of employment. In such a case whenever an employee joins a new job and the first month’s PF contribution is received then a transfer auto trigger is generated. Soon after, the member’s past PF amount gets automatically transferred into his new account. This automatic transfer gets through if not actively stopped by the member.

Ans : No. If you have filed online transfer claim then there is no need to submit a physical copy.

Ans : The Member e-SEWA portal allows the member to track the status of the transfer claim submitted by going to 'Online Services' tab and then to 'Track Claim Status’. Once the claim is submitted the status shown is “Pending with the employer”. If the employer approves transfer request, status of the form changes to - "Accepted by the employer. Pending at Field Office".

Ans : In such a case there is no provision to file online transfer claim. However a physical claim can be filed duly mentioning the previous and present employment details. The physical Form 13(Transfer claim)can be downloaded from https://www.epfindia.gov.in/site_docs/PDFs/Downloads_PDFs/Form13.pdf. The same must be attested by the authorized signatory of either present or previous employer and submitted to the concerned Field Office. In order to avail all the online services after the transfer-in is effected the member is advised to do the KYC of his latest UAN. Thereafter on job change the member must disclose his KYC compliant UAN to his new employer so as to avoid duplicity of UAN number

Ans : Employee is required to submit PF Transfer Claim to the Exempted Trust which will enter the transfer details as Annexure K in Unified Portal. The employer will make the online payment against the Annexure K. After due approval by PF office the past amount and service history gets reflected in his current MID passbook.

Ans : Annexure K is a document which mentions the member details, his PF accumulations with interest, service history, Date of Joining and Date of Exit and employment details including past and present MID. This document is required by the Field Office/Trust to effect a transfer in.

Ans : The member can view the status of any establishment by going to PF establishment search. The member must go to https://www.epfindia.gov.in. Thereafter, go to Our Services> For Employers > Establishment Search (Under head Services). Then the details of the establishment (name or PF Code) can be entered to view the status of the establishment.

Ans : The pensionary benefits are dependent on the length of service and the average of last wages drawn. It does not depend on the actual amount lying in the Pension Fund Account. Hence this amount is not transferred during change of employment and a mere transfer of past service history makes the member eligible for pension related benefits

Ans :

- The provident fund monies are to provide for a source of income (social security) after retirement during old age. To create a sizable savings it is necessary to start saving early and accumulate the corpus by reducing intermittent withdrawals. Hence it is advisable to transfer PF with each job change to reap full benefits of the social security schemes.

- 1. PF transfer lets the past service transferred into the current member ID. If the total service is more than 5 years then TDS is not charged on PF withdrawal. Clubbing of past service may help the member in crossing the 5 year mark thus saving on TDS.

- 2. Transferring PF amount instead of withdrawing gives the member the benefit of compounding of funds. The compounding effect can be visualized in a way that if a member does not withdraw his PF money on change of job and gets it transferred to his new account then the same money would get doubled in approximately 8 years, assuming EPFO continues to give at least 8.5% interest rate just like it has given in the past so many years.

- 3. A service of more than 10 years makes the member eligible for pensionary benefits. Transfer of PF accounts ensures that the past services does not get lapsed and continues to get added in the subsequent employment.

Ans :

| S.N. | Types of PF Transfer | Mode of Transfer |

|---|---|---|

| 1. | Transfer of PF from one un-exempted establishment to another un-exempted establishment. | Online |

| 2. | Transfer of PF from exempted establishment to un-exempted establishment. | Online |

| 3. | Transfer of PF from un-exempted establishment to exempted establishment. | Online |

| 4. | Transfer of PF from exempted establishment to another exempted establishment. | Offline |

| 5. | Transfer of EPS only (for EPF exempt members) from un-exempted establishment to un-exempted establishment. | Online |

Ans : Every establishment covered under the EPF & MP Act, 1952 has to electronically file information after close of every wage month regarding the number of employees employed, their UAN, their Gross/EPF/EPS/EDLI wages, contributions under the three Schemes on such wages and the administrative charges due, wage disbursal date, and number of excluded employees and their gross wages.

The ECR facility on unified portal allows the employer to perform the above important statutory duty.

After creating the above information in the ECR,the employer can use the challan process for payment of the contributions & administrative charges declared by him.

Ans : The ECR created by employer furnishing the statutory information will not lapse and shall always be available at future date for reference to complete the payment.

Ans : No damages will be leviable if deposits are made within the extended time declared by the Central Government.

Ans : Many important tasks like KYC attestation, transfer claim attestation etc are done online by the authorized persons of employer using their digital signatures or Aadhaar based e-Sign on EPFO portal. This ensures seamless online service to members.

Ans : For using DSC/e-Sign, one time approval from Regional Offices of EPFO is required. The employers are required to send one time registration request to regional offices for approval, duly signed by the employer.

Ans : Such establishments whose authorized officers have approved digital signature but are not able to locate the dongle can login to the employer portal and register their e-sigh through the link for registration of already registered authorized signatories. If their name against the approved digital signature is same as that in their Aadhaar, the registration of e-Sign will not require any further approval. Other authorized signatory can register their e-Sign and send the request letter approved by the employer and seek approval of the concerned EPFO Office.

Ans :

- Virtual Id can be generated from UIDAI website. Following is the direct link for virtual ID generation:

- https://resident.uidai.gov.in/vid-generation

Ans : Visit “Establishment >> DSC/e-Sign>>Digital Signature Registration” at Employer Interface. Provide the basic details of authorized signatory. During registration, physical DSC (dongle) should remain attached with machine. System will ask the password of the DSC. Generate the request letter. Employer can upload it online. Regional Office after due verification approves the request.

Ans :

- -> Visit unified member portal

- -> Select Member ID, Aadhaar or PAN

- -> Enter details such as name, date of birth, mobile number and e-mail id as perEPFO records

- -> Click on the “Get Authorization Pin”option

- -> A Pin will be sent to your mobile number registered with EPFO

- -> Enter the Pin and your UAN will be sent to the mobile number

- Visit unified memberportal (https://unifiedportal-mem.epfindia.gov.in/memberinterface/)

Ans :

- -> Visit EPF Member Portal and click on “Activate UAN” OR UAN Activation under Employee Centric Services of EPFO on UMANGAPP

- -> Select any one of the following – UAN, Member ID, Aadhaar or PAN

- -> Fill additional details such as Name, Date of Birth, Mobile Number and Email ID and click on “Get Authorization PIN”

- -> An authorization PIN will be sent to the mobile number registered with EPFO

- -> Enter this PIN and click on “Validate OTP and Activate UAN”

- UAN will be activated and password will be sent to member’s mobile. Now the member can log in to unified member portal using his UAN and password.li>

Ans : Yes, one mobile number can be linked with multiple UANs.

Ans : No. UAN registration and activation is done only online.

Ans : Both contractual, as well as direct employees, can avail UAN facilities online after registration and activation.

Ans : The password should contain atleast 1 Special Character, 7-20 character long, atleast one capital and one small letter, Minimum 4 alphabets and minimum 2 digits.

Ans : Member can himself seed UAN with aadhaar by visiting member portal. Thereafter the employer must approve the same to complete the linkage. Alternatively, member can ask his employer to link aadhaar with UAN.

The member can also use “e-KYC Portal” under Online Service available on home page of EPFO website or e-KYC service under EPFO in UMANG APP to link his/her UAN with Aadhaar without employer’s intervention.

Ans : Member has to apply for correction to Regional office of EPFO where his EPF a/c is maintained through submission of joint request.

Ans :

- -> Login to your EPF account at the unified member portal

- -> Click on the “KYC” option in the “Manage”section

- -> You can select the details(PAN, Bank Account, Aadhar etc)which you want to link with UAN

- -> Fill in the requisite fields

- -> Now click on the “Save”option

- -> Your request will be displayed in “KYC Pending for Approval”

- -> Once employer approves the details the message will be changed to “Digitally approved by the employer”

- -> Once UIDAI confirms your details,“Verified by UIDAI”is displayed against your Aadhaar.

- You can select the details (BankAccount, PAN, Aadhar, Passport)which you want to link with UAN

Ans :

- -> Login to your EPF account at the unified member portal

- -> Enter your bank account number and IFSC code.

- -> OTP will be sent to Aadhaar registered mobile number.

- -> After verification the details have to be approved by your employer.

- -> Once approved the bank account gets seeded.

- The details have to be approved by your employer except in case where the bank account is of State Bank of India.

Ans : Yes. The bank account number can be updated any number of times by following the steps mentioned above. However, the bank account details cannot be changed during pendency of any claim with EPFO.

Ans : You should seed active bank account in your name. In case your name is not correctly mentioned in the bank account, the scanned copy of cheque will show the difference and the claim may be rejected. So it is better to get the names corrected. Also ensure that the bank account does not have a deposit cap greater than your withdrawal benefit.

Ans : UAN has to be activated only once. You do not have to re-activate it every time you switch jobs

Ans : No, UAN registration is free of cost and you do not have to pay any fee to activate it.

Ans : You cannot activate UAN through SMS. However, you can activate UAN through Umang App. To download Umang app, please visit google play store.

Ans :

- Services:

- i. E-Nomination

- ii. Modification in Name, Date of Birth,Gender

- iii. Updation of KYC details

- iv. Seamless Transfer of PF Accumulation from Previous Employment

- v. Online claims(PF Withdrawal, Advance, Withdrawal benefit, Pension Claim)

- vi. Aadhaar based online claim submission

- vii. Updation of date of exit from service li>Information:

- viii. DownloadPassbook

- ix. Download UANCard

- x. PF contributions & balance by sending SMS to 7738299899 in 10 languages

- xi. F account details by missed call on011-22901406

Ans : In case you have requested for a change in date of birth which as per aadhar is having a difference of more than 3 years a document in support of the date of birth in Aadhar has to be uploaded.

Ans : Mobile, Aadhar and Bank account number

Ans : Yes, if you link your PAN number with UAN then you can avail tax benefits on EPF withdrawal.

Ans : Yes one can link PAN with UAN even there is mismatch in name in PAN and UAN data.

The name as per Aadhaar and PAN must be same as that in PF records for KYC to be successfully completed. Please note that the name as printed on PAN card may be different from that in the Income Tax database. In such a case you must enter the name as per IT database to get it successfully linked with UAN. If there is a name mismatch then a name change request can beraised.

Ans : In case your employer is not approving KYC details, you can directly approach administration or HR department with request. If it is taking more time you can escalate it to higher authority in the organization.

If no one is responding to your request you can approach EPF Grievance via https://epfigms.gov.in.

Ans : The status will be shown against updated KYC document on the same page. The system will also trigger SMS on your register mobile number.

Ans : You can login to your member portal and update the PAN and Bank account details yourself. The same will be digitally approved/updated by the employer.

Ans :

- -> Visit Member Unified Portal

- -> Enter UAN, Password and CAPTCHA.

- -> Go to Manage and Click Mark Exit

- -> Choose ‘PF Account Number’ from ‘select employment’ drop down

- -> Enter ‘Date of Exit’ and ‘Reason of Exit’

- -> Click on option‘RequestOTP’and enter OTP sent on your Aadhaar linked Mobile Number

- -> Give your consent by selecting the Checkbox

- -> Click ‘Update’

- -> Click ‘OK’

Ans : After login into the Member Interface of Unified Portal, there is a provision in “Member Profile” section to change your mobile number.

Ans : No, you cannot submit online claim if your mobile is not linked with Aadhaar. At the time of claim submission, OTP is sent to Aadhaar linked mobile only.

Ans : Please visit your nearest Aadhaar Service Centre. For more details you can visit official website of UIDAI https://uidai.gov.in .

Ans : Please click on “Forgot Password” at Member Interface of Unified Portal. Provide your UAN with CAPTCHA. System will send the OTP on your mobile which is seeded with UAN and you can reset the password.

Ans : Please click on “Forgot Password” at Member Interface of Unified Portal. Provide your UAN with CAPTCHA. System will ask whether OTP is to be sent on registered mobile or some other mobile. If other mobile number is selected the system will ask to enter your basic details (Name, DOB and Gender). After successful matching of basic details system will ask to provide your Aadhaar. If Aadhaar details are matched system will ask new mobile number and OTP will be sent to the new mobile. After successful verification of OTP, you can reset your password.

Ans : You need to simply declare your UAN with your subsequent employer.

Ans : You can file Withdrawal,Advance, Transfer and Pension claim (after

e-Nomination)online through EPFO Member Portal or through Umang app

Ans : First of all, you need to login to the UAN Member Portal with your UAN and password. Then go to the menu ‘Download’ and select ‘Download Passbook’. A link provided to download PDF of this passbook.

Ans : You need to login first with your valid UAN and password. Then go to ‘Download’ Menu and select an option ‘Download UAN Card’. PDF of UAN card can be downloaded.

Ans : In case you are working in an Exempted establishment then your passbook will not be available in the UAN portal. You may contact your establishment to get the PF statement.

Ans : Transfer all the previous services linked with previous UANs to present UAN through One Member One EPF Account facilty of Member Interface.

Ans : As the details are matched with previous Member ID w.r.t. current Member ID and if there is any deviation in name etc. it will not allow for link / list Member ID.

Ans :

- -> Visit Member Unified Portal as mentioned in

- -> Enter UAN, Password and CAPTCHA.

- -> Click Sign-in

- -> Click Manage and then Click Modify Basic Details

- -> Enter Aadhaar, Name and DOB as per Aadhaar.Click Save/Submit.Click Yes

- -> Inform your Employer to approve your Name Change Request.

Ans : YES. The provisions related to Advances in the scheme apply to International workers also.

Ans : Not mandatory. However , if in KYC documents such as Aadhaar, Bank Account etc., if husbands name is furnished, then it is advisable to furnish the same in PF details also.

Ans : For submitting Online Claims, Aadhaar is mandatory. An International worker who has been allotted aadhar on becoming eligible for the same can thereafter file online claim. If IW does not have an Aadhar, the IW can submit physical claim form duly attested by employer/authorized representative.

Ans : Yes. The contribution card of each member in Form 3-A/ECR copy can be demanded from the employer.

Ans : Update Form-2 (Nomination) online through Member Portal.

The date of birth is based on Aadhar in e-nomination. So change will be required only when you have got Aadhar corrected. The earlier e-signed e-nomination can be changed by filing a fresh nomination linking the updated Aadhar and e-signing the nomination again.

Ans : Please transfer the balance and service to current UAN by submitting online Form-13.

For this you have to get the data (name, date of birth and gender) corrected in pervious UAN (if not correct and not matching with aadhar data) through the previous employer and link the UAN with aadhar. In case data is correct then you can yourself link it through eKYC Portal.

Ans : After 60 Days from the date of leaving of services, the member can him self submit / update Date of Exit online through Member Portal.

Ans : The Employer can make a request to the concerned PF Office for corrections.

Ans : No, Employer need to approve the KYC of the employee. Employer can register for e-sign which is Aadhar based and then approve the details.

Ans : Above situation occurs when Date of exit of previous service is not available in unified Portal. After updating date of exit, submit online Form-13 and transfer the previous account to current member account.

Ans : Not required. Member has to use Aadhaar based e-Sign to file the e-Nomination.

Ans : Member can generate his UAN against the member id if the data matches, else he has to approach the employer for generating the UAN with correct details and get the erroneous details corrected. Then member can link his KYC himself.

Ans : Beneficiary can apply online only when the member had filed e-nomination. So, file physical claim through the authentication of the employer with necessary documents and proof.

Ans : UAN can be linked with aadhar by member through e-KYC Portal if data matches. In case of any correction the employer will have to certify and then only the concerned PF Office will approve changes. There is also facility to link other member ids with UAN but first link the UAN with aadhar.

Ans : Please consult UIDAI for corrections

Ans : Submit Joint Declaration through employer along with Aadhaar details.

Ans : Register the DSC as per the procedure prescribed. You can also register for e-sign that is Aadhar based.

Ans : In case the member has died then no fresh nominee (for PF including EDLI) can be added in case a valid nomination is available. Only the member had the right to nomination. Nomination cannot be changed after death. Only eligible family details can be added for pension by the concerned PF Office.

Ans : Yes you can apply.

Ans : Update data as per Aadhaar in the PF records. The error is displayed when the data of UAN and aadhar does not match.

Ans : In Member Login it cannot be done as member has already died so how will he update. However, the DOE can be updated by the employer by mentioning the reason as death.

Ans : Please contact the employer.

Ans : Yes if the account is not settled and there is no need for change in basic details.

Ans : Only latest bank account is active. If the latest one is wrong, get the correct one added. In case of non SBI bank account the employer has to approve the details and in case of SBI the account will be digitally verified from bank. The name should be correct in Bank account.

Ans : At present the facility is through employer only if the account is not in SBI.

Ans : Nominee details can be added by any member whose profile section is complete and UAN is verified against the aadhar. Nominee details can be added if aadhar of the family members are available and the photo is also ready for upload.

Ans : Yes, Online Claim can be filed

Ans : Yes. But even for physical claim now the UAN and aadhar verification of the UAN is must and in such case, you can file online claim for faster processing.

Ans : Update proper KYC . If both UAN are seeded with same Aadhar system will allow application.

Ans : Both employers will use the same UAN and enter the respective date of joining. On exit they will enter the date of exit in their establishment form their login.

Ans : In respect of closed establishment, where the employee finds it difficult to get the attestation of the employer, the member can update the KYC by submitting a request to concerned field office duly attested by one of the authorized officials. The complete list of authorized officials is as prescribed in para 10.18 of the MAP Vol. II

Ans : In respect of closed establishment, where the employee finds it difficult to get the attestation of the employer, the member can update the KYC by submitting a request to concerned field office duly attested by one of the authorized officials. The complete list of authorized officials is as prescribed in para 10.18 of the MAP Vol. II

Ans : Contact employer to get the reason of exit rectified through the concerned PF Office.

Ans : Get the data in UAN corrected through joint declaration through the employer.The claim is likely to be rejected in case of mismatch.

Ans : Contact the employer to reject the pending KYC

Ans : It is possible to different Date of Exist for EPF and EPS, Please note that the date of exit form EPS may be blank if member is not an EPS member. It can be also earlier that date of exit PF only when the member has completed 58 years age. But it cannot be later than the exit form PF. For an EPS member not completed 58 years the date of exit in both has to be same.

281 - Can my ex-employer enter different DoE for EPF and EPS, or enter DoE for only EPF or only EPS?

Ans : It is possible to different Date of Exist for EPF and EPS, Please note that the date of exit form EPS may be blank if member is not an EPS member. It can be also earlier that date of exit PF only when the member has completed 58 years age. But it cannot be later than the exit form PF. For an EPS member not completed 58 years the date of exit in both has to be same.

Ans : Contact the concern EPFO field office with error as any employer can link your UAN only when you have shared the UAN and aadhar with him.

Ans : An International Worker (IW) may be an Indian Worker or a foreign national. International Worker means :-

- Any Indian employee having worked or going to work in a foreign country with which India has entered into a social security agreement and being eligible to avail the benefits under social security program of that country, by virtue of the eligibility gained or going to gain under the said agreement:

- An employee other than an Indian employee, holding other than an Indian Passport, working for an establishment in India to which the EPF & MP Act, 1952 applies ;

Ans : ‘Excluded’ employee means:-

A detached International Worker contributing to the Social Security program of the home country and certified as such by a Detachment Certificate for a specified period in terms of the bilateral SSA signed between that country and India. Or

An International Worker, who is contributing to a social security program of his country of origin, either as a citizen agreement containing a clause on social security prior to 1st October, 2008 which specifically exempts natural persons of either country to contribute to the social security fund of the host country (e.g. para 4 of

Article 9.3 CECA between India and Singapore provides that “Natural persons of either party who are granted temporary entry into the territory of the other party shall not be required to make contributions to social security funds in the host country).

(As per Scheme provisions)

Ans : a) Every International Worker, other than an excluded employees’- from 1st October, 2008 or date of joining EPF covered establishment.

b) Every excluded employee – from the date he ceases to be excluded employee due to expiry of his period of COC.

Ans : No, minimum period is prescribed. Every eligible International Worker has to be enrolled from the first date of his employment in India.

Ans : No, there is no cap on the salary on which contributions are payable by the IW as well as the employer.

Ans : A Social Security Agreement is bilateral Agreement between India and another country to ensure continuity of social security coverage of workers posted in another country. Being a reciprocal arrangement, it generally provides for avoidance of double coverage.

Ans :

- Generally, a Social Security Agreement covers three provisions. They are:

- a. Detachment : International Workers deputed to work in a country having an Agreement on Social Security with their home country are not required to contribute to the social security system in the host country, provided they are contributing to the social security system of the home country.

- b. Exportability of Pension : Provision for payment of pension benefits directly without any reduction to the beneficiary choosing to reside in the territory of the home country as also to the beneficiary choosing to reside in the territory of a third country as outlined in the respective SSA

- c. Totalization of Benefits : Service rendered in the SSA country is added to the service rendered in India to determine the eligibility for Pension

- d. Equality of treatment: equality of treatment to the IWs from an SSA country with the host country workers.

Ans : India has signed 20 SSAs out of which 19 Social Security Agreement have been made effective from the dates mentioned against them :

| S.No. | Country | Date of coming into Effect | Period of Detachment allowed |

|---|---|---|---|

| 1. | Belgium | 01-09-2009 | 5 years |

| 2 | Germany | 01.10.2009 | 4 years |

| 3 | Switzerland | 29-01-2011 | 6 years |

| 4 | Denmark | 01-05-2011 | 5 years (for Indians) 3 years (for Danish) |

| 5 | Luxembourg | 01-06-2011 | 5 years |

| 6 | France | 01-07-2011 | 5 years |

| 7 | South Korea | 01-11-2011 | 5 years |

| 8 | Netherlands | 01-12-2011 | 5 years |

| 9 | Hungary | 01-04-2013 | 5 years |

| 10 | Finland | 01-08-2014 | 5 years |

| 11 | Sweden | 01-08-2014 | 2 years |

| 12 | Czech Republic | 01-09-2014 | 5 years |

| 13 | Norway | 01-01-2015 | 5 years |

| 14 | Austria | 01-07-2015 | 5 years |

| 15 | Canada | 01-08-2015 | 5 years |

| 16 | Australia | 01-01-2016 | 5 years |

| 17 | Japan | 01.10.2016 | 5 years |

| 18 | Quebec | 01.04.2017 | 5 years |

| 19 | Portugal | 08.05.2017 | 5 Years |

| 20 | Brazil | Yet to enter into force | 5 Years |

Ans : Each and every worker from a country not having either SSA or bilateral comprehensive economic agreement (referred to in answer under FAQ 2) with India has to contribute mandatorily.

Ans : Yes, IWs drawing salary in any currency and in any manner are to be covered as IWs. The contribution in respect of such IWs will be computed in INR. The rate of conversion of that currency shall be the telegraphic transfer buying rate offered by the State Bank of India for buying such currency on the last working day of the month for which wages is due.

Ans : A foreigner employed directly by an Indian establishment would be coverable, if the establishment is covered/coverable under the EPF and MP Act, 1952.

Ans : Only, those IWs who are covered by a SSA will be eligible for withdrawal benefit under the EPS, 1995 provided they have not rendered the eligible service (i.e.10 years) even after including the totalisation benefit, if any, as may be provided in the said agreement.

Ans : In case of IWs from Non SSA countries, withdrawal benefit under the EPS, 1995 will not be available.

Ans :

- The full amount standing to the credit of a member’s account is payable in the following circumstances:

- a. Persons covered SSA –

On ceasing to be an employee in an establishment covered under the Act. - b. Persons NOT covered SSA –

- (i) On retirement from service in the establishment at any time after 58 years of age;

- (ii) On retirement on account of permanent and total incapacity for work due to bodily or mental infirmity, duly certified by the authorized medical officer.

Ans : Certificate of Coverage (COC) is a certificate issued by the liaison Agencies of the respective SSA country, with whom India has signed Social Security Agreement (SSA), certifying therein that the person who is being deputed India, is covered under the Social Security System of his home country.

EPFO issues COC in respect of Indian workers being deputed to SSA countries and based on this Certificate Indian Workers are entitled to exemption from contributing under Social Security System of host country.

Ans : The office of the Regional PF Commissioners are the competent Authorities to issue the COC in respect in respect of Indian Workers being deputed to SSA countries.

Ans : All foreign nationals, including OCI/PIO card holders are required to be enrolled and comply with EPFO, as IWs.

Ans : Yes, as portability has been provided in the SSAs, the persons covered under such SSA can opt for payment of Pension benefits in their home country .

Ans : For availing the COC, the prescribed online application forms, available on International Workers Portal on the official website of EPFO, needs to be filled up by the employee, approved by the employer using e-sign and submitted online to the office of EPFO, under whose jurisdiction the establishment is registered.

Ans : The proviso to Substituted Para 2(ja) under Para 83 of the EPF Scheme provides that Nepalese and Bhutanese nationals shall be deemed to be Indian Workers.

Ans : Yes, contribution in the EDLI Scheme has to be made on the wage ceiling of Rs 15000/- .